Are you contemplating selling your stocks today? It's a decision that can significantly impact your financial future. In this article, we'll delve into the factors you should consider before making that crucial decision. Whether you're a seasoned investor or a beginner, understanding these key points can help you make an informed choice.

Understanding the Market Trends

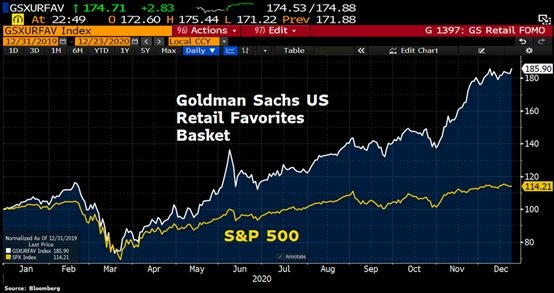

One of the first things you need to consider is the current market trends. Are the markets rising, or are they falling? This will give you a clue about the potential performance of your stocks. For instance, if the market is experiencing a bull run, it might be a good time to sell and lock in your gains. Conversely, if the market is in a bearish phase, it might be wise to hold onto your stocks for a while longer.

Analyzing Your Stocks' Performance

Next, analyze the performance of your stocks. Have they been consistently increasing in value, or have they been underperforming? Look at the past year's performance and compare it to the market average. If your stocks have significantly underperformed, it might be time to consider selling.

Assessing Your Financial Goals

Consider your financial goals. Are you looking to diversify your portfolio, or are you aiming for long-term growth? Selling stocks that are not aligned with your goals can help you better achieve your financial objectives. For example, if you're looking for stability, you might want to sell high-risk stocks and invest in more conservative ones.

Evaluating Your Risk Tolerance

Your risk tolerance is another crucial factor. If you're not comfortable with the volatility of your stocks, it might be time to sell. High-risk stocks can offer high returns, but they also come with a higher chance of loss. Assess your risk tolerance and decide if it's worth the potential drawbacks.

Keeping an Eye on the News

Stay updated with the latest news and events that can impact the stock market. Economic reports, political events, and corporate news can all influence stock prices. For instance, if a company you're invested in is facing legal issues, it might be wise to sell your shares before the situation worsens.

Understanding Dividends

If your stocks pay dividends, consider the yield. High-dividend stocks can provide a steady stream of income, but they might not offer the same growth potential as high-risk stocks. Assess whether the dividends align with your financial goals and decide if selling your stocks is the right move.

Case Studies

Let's consider a couple of case studies to illustrate the importance of these factors:

Case Study 1: John invested in a high-risk tech stock, hoping for rapid growth. However, the stock's performance started to decline, and the market was experiencing a bearish phase. John, who had a low risk tolerance, decided to sell his stocks to minimize potential losses.

Case Study 2: Sarah had a well-diversified portfolio that included high-dividend stocks. She assessed her financial goals and realized she needed more stability. After evaluating her stocks' performance and considering the market trends, Sarah decided to sell some of her high-risk stocks and invest in more conservative ones.

In conclusion, deciding whether to sell your stocks today requires careful consideration of various factors. By analyzing market trends, assessing your financial goals, evaluating your risk tolerance, and staying informed about the latest news, you can make an informed decision that aligns with your investment strategy.

us flag stock