The stock market is often unpredictable, but on Wednesday, U.S. stocks showed a strong rebound that left many investors optimistic about the future. This article will delve into the reasons behind this sudden upswing and examine how it might impact the market going forward.

Market Overview:

On Wednesday, the major stock indexes in the U.S. experienced a significant upturn. The S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite all posted gains of more than 2%. This rebound came as a welcome surprise to many, given the recent volatility in the market.

Reasons for the Rebound:

Several factors contributed to the stock market's strong performance on Wednesday. One of the primary reasons was the positive news regarding the economic outlook. In recent weeks, several economic indicators, such as consumer spending and industrial production, have shown signs of improvement. This has led many investors to believe that the U.S. economy is on the mend, which is a positive sign for the stock market.

Another factor that played a role in the rebound was the announcement of new stimulus measures by the Federal Reserve. The Fed has been under pressure to take action to boost the economy, and their recent move to lower interest rates and increase the money supply was seen as a positive sign by many investors.

Sector Performance:

The rebound was not uniform across all sectors. Some sectors, such as technology and financials, saw particularly strong gains. Tech stocks, which have been hit hard in recent months, experienced a significant bounceback. This can be attributed to the optimism surrounding the upcoming earnings season, as well as the growing demand for technology products in a post-pandemic world.

In addition, financial stocks saw a boost as investors looked to take advantage of the low interest rates. This is especially true for companies that are heavily involved in lending and investment banking.

Impact on Investors:

The rebound in U.S. stocks on Wednesday was a positive development for investors. However, it is important to remember that the stock market is unpredictable and that there are still many risks that could cause it to decline in the future. Investors should carefully consider their investment strategies and stay diversified to mitigate potential risks.

Case Studies:

To illustrate the impact of the market's recent performance, let's take a look at two companies: Apple and Bank of America.

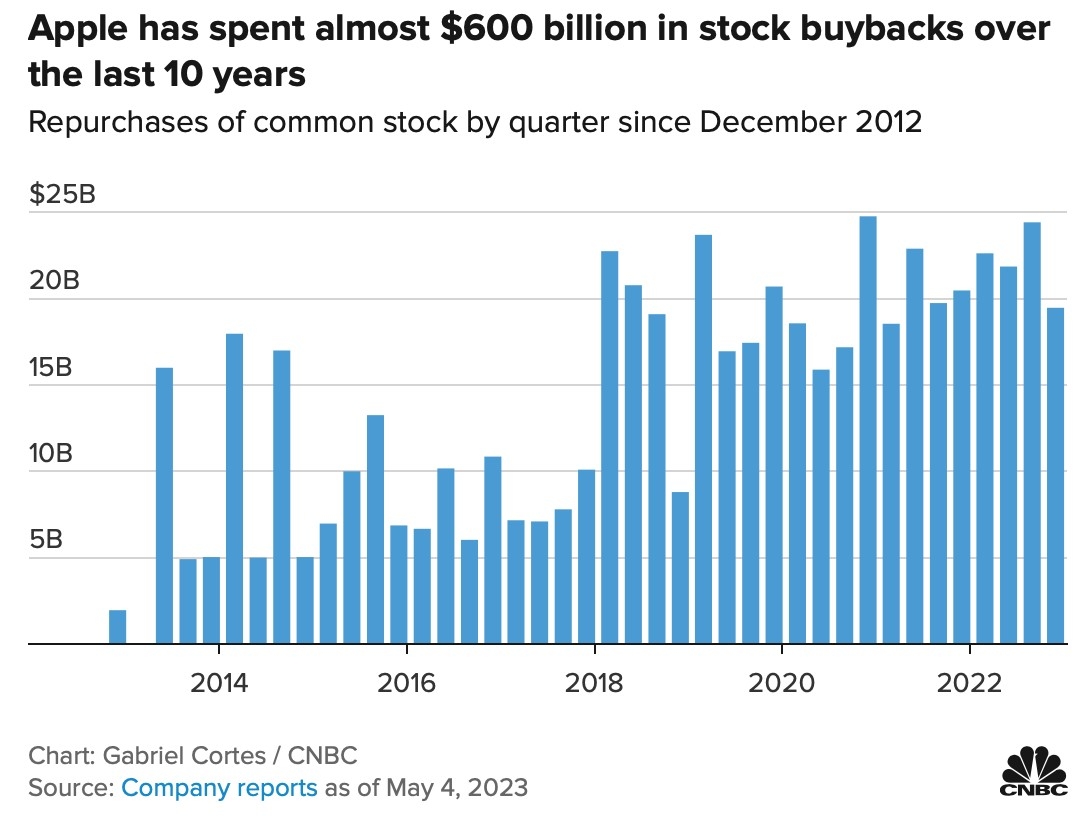

Apple has seen a significant increase in its stock price in recent weeks. The company's strong earnings report and growing demand for its products have contributed to this surge. As the world continues to move towards a digital economy, Apple's position as a leader in technology makes it an attractive investment for many investors.

Bank of America, on the other hand, has seen a strong rebound in its stock price as a result of the low interest rates and increased lending activity. The bank has been actively working to improve its lending practices and has seen a positive response from investors as a result.

Conclusion:

The rebound in U.S. stocks on Wednesday was a significant development that has left many investors optimistic about the future. While there are still risks that could cause the market to decline, the positive economic indicators and stimulus measures by the Federal Reserve suggest that the market may continue to perform well in the near term. Investors should carefully monitor the market and consider their investment strategies accordingly.

us stock market today