The Dow Industrial Average has long been a bellwether for the health of the U.S. stock market. As investors and economists alike keep a close eye on this crucial index, it's essential to understand its current state and potential future movements. In this article, we'll delve into the latest figures, insights, and predictions surrounding the Dow Industrial Average.

Understanding the Dow Industrial Average

The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ. It includes some of the most influential companies in the United States, such as Apple, Microsoft, and Visa. The index serves as a benchmark for the broader market and is widely followed by investors, analysts, and the media.

Current State of the Dow Industrial Average

As of [insert current date], the Dow Industrial Average stands at [insert current value]. This figure reflects the combined performance of the 30 component stocks and provides a snapshot of the broader market's health. It's important to note that the Dow can fluctuate significantly from day to day, often influenced by various economic and political factors.

Recent Trends and Factors Influencing the Dow

Several factors have contributed to the current state of the Dow Industrial Average. Here are some key trends and influences:

Economic Growth: Strong economic growth, particularly in the United States, has been a positive driver for the Dow. Factors such as low unemployment, rising wages, and increased consumer spending have all contributed to the index's upward trend.

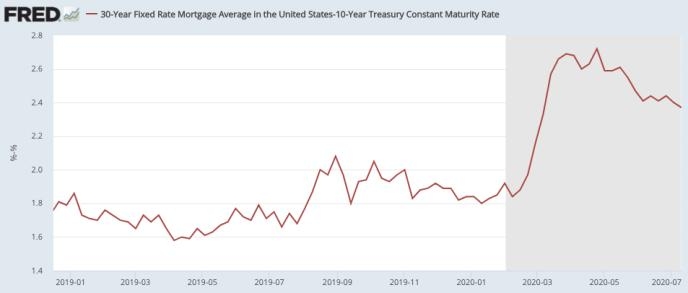

Interest Rates: The Federal Reserve's monetary policy, particularly changes in interest rates, has a significant impact on the stock market. Lower interest rates can encourage borrowing and investment, which can boost stock prices.

Political Factors: Global political events, such as elections and trade disputes, can also influence the Dow. For example, the recent U.S.-China trade tensions have caused volatility in the market.

Corporate Earnings: The financial performance of individual companies within the Dow can also impact the index. Strong earnings reports from major companies can drive the index higher, while disappointing results can lead to declines.

Predictions for the Future

While predicting the future movements of the Dow Industrial Average is inherently uncertain, some experts have shared their insights:

Economic Growth: Many analysts believe that continued economic growth, particularly in the United States, will support the Dow's upward trend. However, potential risks such as rising inflation and trade tensions could pose challenges.

Market Volatility: Some experts predict that the market will experience increased volatility in the coming months. This could be due to a variety of factors, including economic uncertainty and political events.

Dividends and Earnings: As companies continue to report strong earnings and increase dividends, the Dow may continue to rise. However, it's important to keep an eye on individual company performance and economic indicators.

Case Study: Apple's Impact on the Dow

A prime example of how individual companies can influence the Dow is Apple Inc. As the largest company by market capitalization, Apple's performance has a significant impact on the index. In recent years, Apple has consistently reported strong earnings and increased dividends, contributing to the Dow's overall upward trend.

In conclusion, the Dow Industrial Average remains a critical indicator of the U.S. stock market's health. While the index can be influenced by various economic and political factors, it's essential to stay informed and monitor the latest trends and predictions. As always, it's crucial for investors to conduct their own research and consult with financial professionals before making investment decisions.

us stock market today