The US stock market has been a hot topic of discussion lately, with many experts questioning whether it's currently experiencing a bubble. In this article, we delve into the factors contributing to the market's rise and examine whether it's on the brink of bursting.

Historical Context

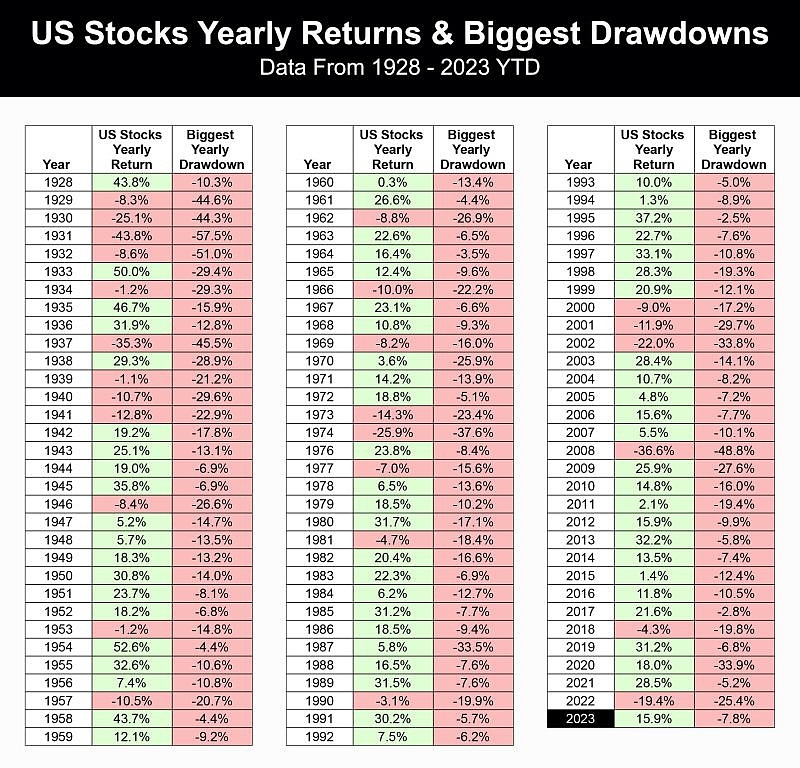

To understand the current state of the US stock market, it's important to look at historical trends. In the past, the stock market has experienced several bubbles, including the dot-com bubble of the late 1990s and the housing market bubble that led to the 2008 financial crisis. While these bubbles were eventually burst, they had significant impacts on the economy.

Current Market Trends

Several factors have contributed to the current rise in the US stock market. One of the main reasons is the low-interest-rate environment, which has made it cheaper for companies to borrow money and invest in growth. Additionally, the Federal Reserve's accommodative monetary policy has supported the market by keeping interest rates low.

Another factor is the strong performance of technology companies, which have accounted for a significant portion of the market's growth. Companies like Apple, Amazon, and Microsoft have seen their stock prices soar, driving the overall market up.

Bubble Indicators

To determine whether the US stock market is a bubble, we can look at several indicators. One common indicator is the price-to-earnings (P/E) ratio, which measures how much investors are willing to pay for each dollar of earnings. A high P/E ratio can indicate that the market is overvalued.

Currently, the US stock market's P/E ratio is at a level not seen since the dot-com bubble. This has raised concerns that the market may be overvalued and due for a correction.

Market Volatility

Another indicator of a potential bubble is market volatility. When markets are highly volatile, it can be a sign that investors are becoming overly optimistic or pessimistic, which can lead to extreme price movements.

The US stock market has experienced increased volatility in recent months, which has some experts worried that it could be a sign of a bubble.

Case Studies

To further understand the potential for a bubble in the US stock market, let's look at a couple of case studies. The dot-com bubble of the late 1990s saw technology stocks soar, only to crash when investors realized that many of these companies were not profitable. Similarly, the housing market bubble in the early 2000s saw home prices skyrocket, leading to the financial crisis when the bubble burst.

Conclusion

While it's difficult to predict the future of the US stock market, the current indicators suggest that there may be a bubble forming. However, it's important to remember that markets can be unpredictable, and even if a bubble does burst, it doesn't necessarily mean the end of the world. As investors, it's crucial to stay informed and make informed decisions based on thorough analysis.

us stock market live