Quantitative easing (QE) has become a cornerstone of modern monetary policy, particularly in the United States. This unconventional approach to monetary stimulus involves the Federal Reserve purchasing large quantities of securities to boost economic activity. The impact of QE on the US stock market has been significant, with investors and analysts closely monitoring its effects. This article delves into the relationship between quantitative easing and the US stock market, exploring the mechanics, the impact, and the implications.

Understanding Quantitative Easing

Quantitative easing is a monetary policy tool used by central banks to stimulate the economy when traditional monetary policy, such as adjusting interest rates, is no longer effective. During QE, the central bank buys government securities or other financial assets from the market, thereby injecting money into the economy. This process is intended to lower long-term interest rates, encourage borrowing and investment, and stimulate economic growth.

The Impact of Quantitative Easing on the US Stock Market

The US stock market has been a major beneficiary of quantitative easing. Several key factors contribute to this relationship:

Lower Interest Rates: QE typically leads to lower interest rates, making borrowing cheaper for companies and individuals. This encourages investment and can boost stock prices.

Increased Liquidity: The injection of money into the economy through QE increases liquidity, which can lead to higher stock prices as investors have more money to invest.

Risk-On Sentiment: QE often leads to a "risk-on" sentiment in the market, as investors become more willing to take on risk. This can drive stock prices higher, particularly for riskier assets like stocks.

Valuation Levels: QE can lead to higher valuation levels in the stock market, as investors become more optimistic about the future.

Case Studies

One notable example of the impact of QE on the US stock market is the period following the 2008 financial crisis. The Federal Reserve implemented several rounds of QE, which helped to stabilize the economy and boost stock prices. The S&P 500, for instance, saw a significant rebound during this period, rising from around 670 in March 2009 to over 2,900 by the end of 2021.

Another example is the period following the COVID-19 pandemic. The Federal Reserve implemented unprecedented levels of QE to support the economy, and the stock market responded positively. The S&P 500, which had dipped below 2,200 in March 2020, recovered to over 4,300 by the end of 2021.

Conclusion

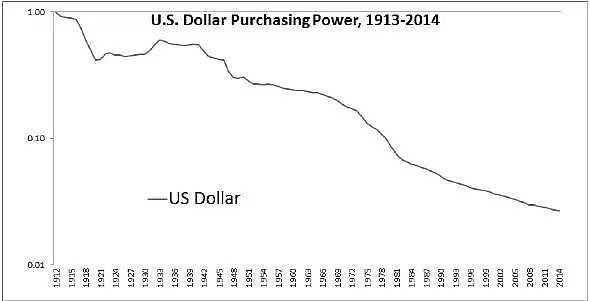

Quantitative easing has had a profound impact on the US stock market, with lower interest rates, increased liquidity, and risk-on sentiment all contributing to higher stock prices. While the benefits of QE are clear, it's important to monitor its potential drawbacks, such as inflation and asset bubbles. As the Federal Reserve continues to navigate the complexities of monetary policy, investors will need to stay informed about the potential impact of QE on the stock market.

shot stock news today