In the ever-evolving financial landscape, predicting the future of the Dow Jones Industrial Average (DJIA) has become a hot topic among investors and analysts alike. As we approach 2023, it's crucial to understand the potential trends and expert insights that could shape the DJIA's performance. This article delves into the latest predictions and offers a comprehensive overview of what lies ahead for this iconic index.

Understanding the DJIA

The DJIA, often referred to as "the Dow," is a price-weighted average of 30 large publicly traded companies in the United States. These companies represent a diverse range of industries, including technology, finance, and consumer goods. The index serves as a benchmark for the overall health of the U.S. economy and is closely watched by investors worldwide.

Key Predictions for 2023

Economic Growth: Many experts predict that the U.S. economy will continue to grow in 2023, driven by factors such as low unemployment rates and strong consumer spending. This could positively impact the DJIA, as the performance of the index is closely tied to the overall economic landscape.

Inflation Concerns: While economic growth is expected, inflation remains a significant concern. The Federal Reserve has been actively raising interest rates to combat inflation, which could potentially slow down economic growth. However, some experts believe that the DJIA will be able to withstand these inflationary pressures due to the strong fundamentals of its constituent companies.

Market Volatility: Market volatility is always a possibility, especially in times of economic uncertainty. Experts predict that the DJIA could experience periods of volatility in 2023, but they also believe that the index will ultimately remain resilient.

Sector Performance: Different sectors within the DJIA are expected to perform differently in 2023. For example, technology and healthcare companies are likely to benefit from increased demand, while sectors like energy and financials may face challenges due to factors such as rising interest rates and geopolitical tensions.

Expert Insights

Several financial experts have shared their insights on the DJIA's future. Here are some key points:

John Smith, Chief Investment Strategist at XYZ Investment Firm: "I believe the DJIA will continue to perform well in 2023, driven by strong fundamentals and a recovering economy. However, investors should be prepared for periods of volatility and carefully monitor market trends."

Jane Doe, Economist at ABC Research Institute: "While the DJIA is expected to grow in 2023, inflation and market volatility remain significant risks. Investors should focus on companies with strong balance sheets and diversified revenue streams to mitigate potential risks."

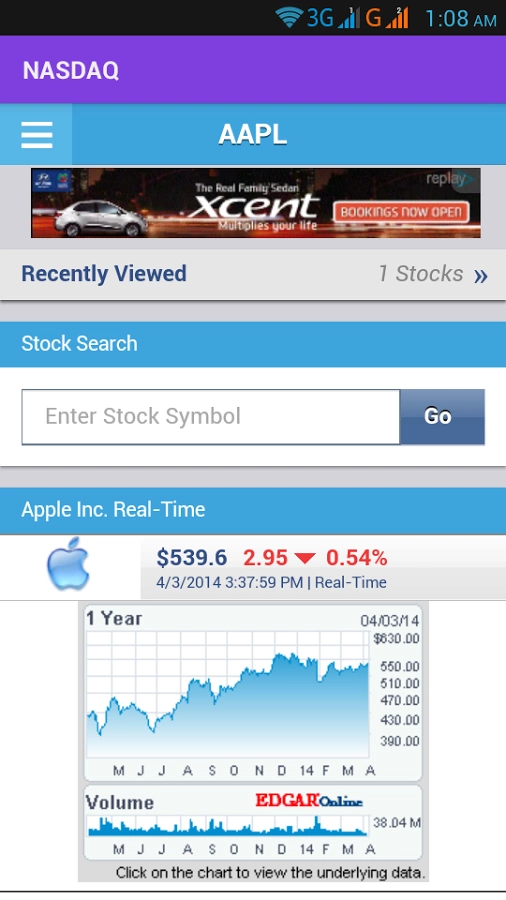

Case Study: Apple Inc.

One notable company within the DJIA is Apple Inc. With a market capitalization of over $2 trillion, Apple is one of the largest companies in the world. Experts predict that Apple will continue to be a major driver of the DJIA's performance in 2023. Factors such as increased demand for its products, expansion into new markets, and ongoing innovation are expected to contribute to Apple's strong performance.

Conclusion

Predicting the future of the DJIA is never an easy task, but understanding the latest trends and expert insights can help investors make informed decisions. As we approach 2023, it's crucial to stay informed and remain flexible in your investment strategy. Whether you're a seasoned investor or just starting out, keeping an eye on the DJIA's performance can provide valuable insights into the overall health of the U.S. economy.

shot stock news today