In the world of finance, the S&P 500 is a term that often comes up. But what exactly are S&P 500 stocks, and why are they so crucial in the investment landscape? This article delves into the details, offering a comprehensive guide to understanding S&P 500 stocks.

What are S&P 500 Stocks?

The S&P 500, or Standard & Poor's 500, is a stock market index that tracks the performance of 500 large companies listed on stock exchanges in the United States. These companies represent a wide range of industries, including technology, healthcare, finance, and consumer goods.

Why are S&P 500 Stocks Important?

S&P 500 stocks are significant for several reasons. Firstly, they are often considered a bellwether of the U.S. economy. When the S&P 500 is performing well, it typically indicates that the overall economy is doing well. Secondly, these stocks are highly liquid, meaning they can be bought and sold easily. Lastly, they offer investors a diversified portfolio, as they represent a wide range of industries.

Key Features of S&P 500 Stocks

Investing in S&P 500 Stocks

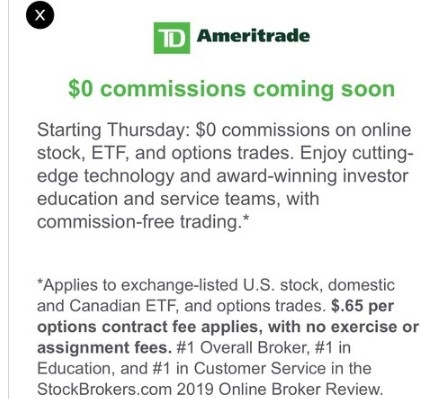

Investing in S&P 500 stocks can be done in several ways. One of the most common methods is through a mutual fund or an exchange-traded fund (ETF) that tracks the index. This allows investors to gain exposure to the S&P 500 without having to buy individual stocks.

Case Study: Vanguard S&P 500 ETF

One popular ETF that tracks the S&P 500 is the Vanguard S&P 500 ETF (VUSA). This ETF has a low expense ratio, making it an attractive option for investors looking to gain exposure to the S&P 500 at a low cost.

Understanding Risks

As with any investment, there are risks involved. The S&P 500 can fluctuate significantly, and investors may experience losses. It's important to understand these risks and to invest in a diversified portfolio.

Conclusion

S&P 500 stocks are a crucial part of the investment landscape. Understanding what they are and how they work can help investors make informed decisions. Whether you're a seasoned investor or just starting out, the S&P 500 is a valuable tool to consider.

new york stock exchange